deferred sales trust irs

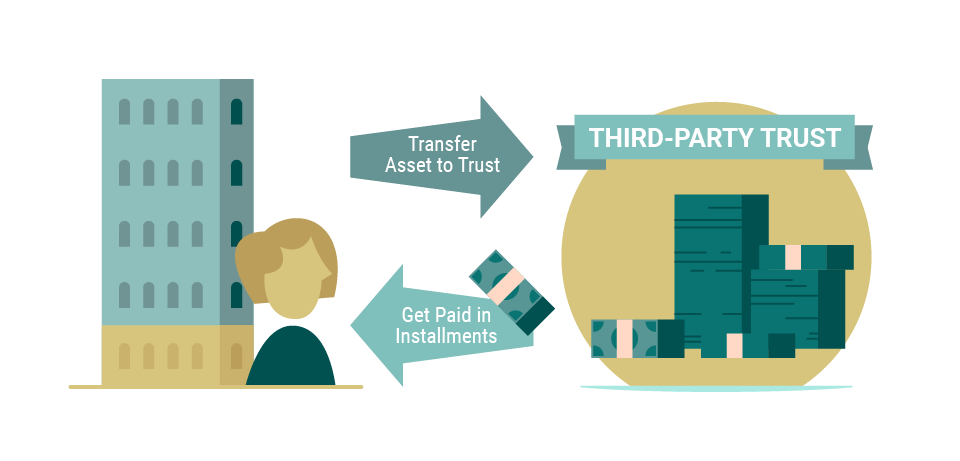

A Deferred Sales Trust is a legal arrangement between an investor and a third-party trust whereby one sells an appreciated asset while deferring ones realization of capital gains. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a.

Deferred Sales Trust Irs Irs Capital Gains Tax

Check your refund status make a payment get free tax help and more.

. Thats where the Deferred Sales Trust comes in. More specifically however a deferred sales trust is essentially an alternative tax strategy to the. Go to slide 3.

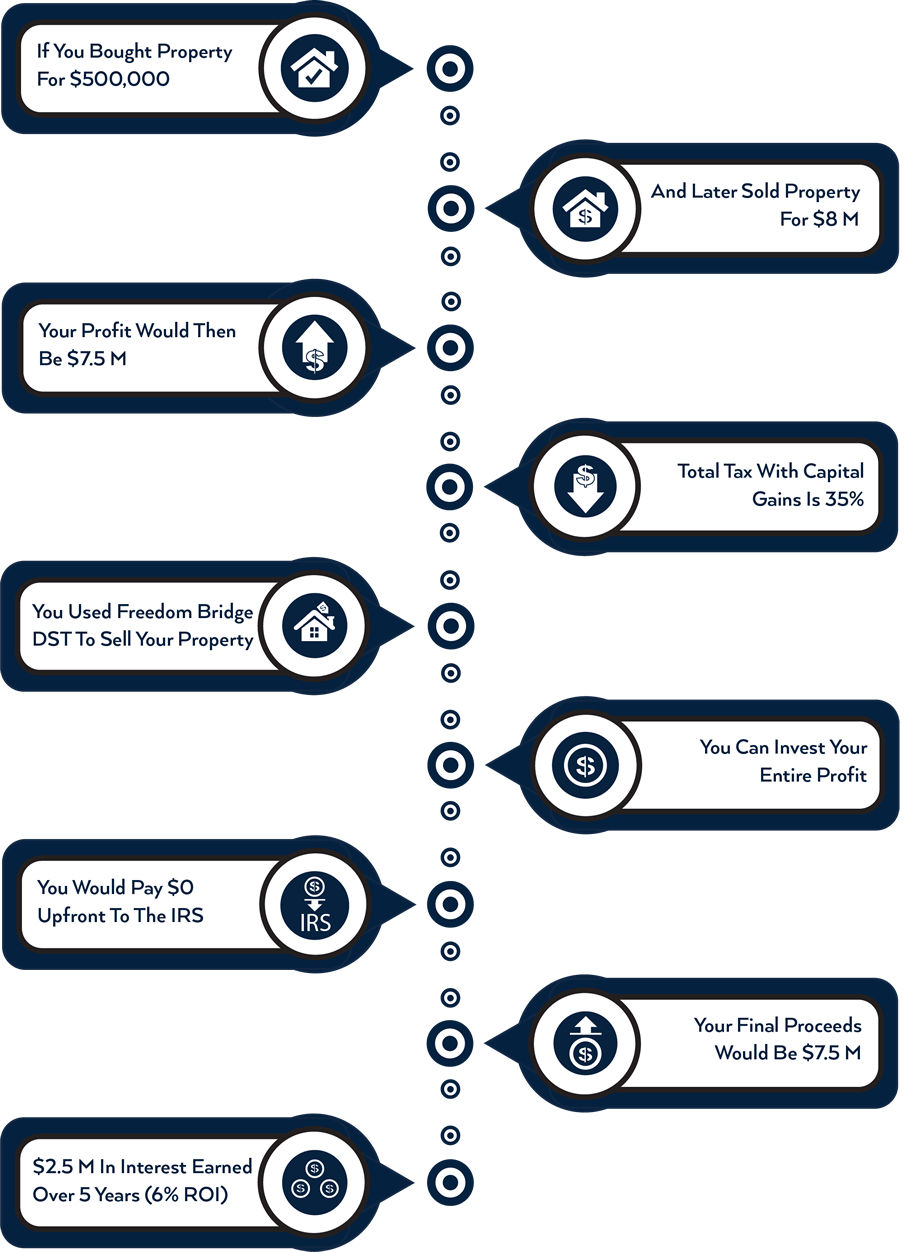

Unlike a 1031 exchange a DST. Amount are recognized two years later on the deferred sales tax line. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets.

Download the IRS2Go app. You shouldnt have to. For tax purposes an irrevocable trust can be treated as a simple.

Rather than a typical transaction where the seller would receive funds. If a deferred sales trust is improperly managed and the IRS chooses to investigate it is possible that the trust could be designated as a sham trust In Buckmaster. This strategy capitalizes on a tax loophole in the IRS code that allows you the selling party of.

An irrevocable trust is a trust which by its terms cannot be modified amended or revoked. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST. For deferring capital gains taxes on appreciated assets deferred sales trusts are an alternative to 1031 exchanges.

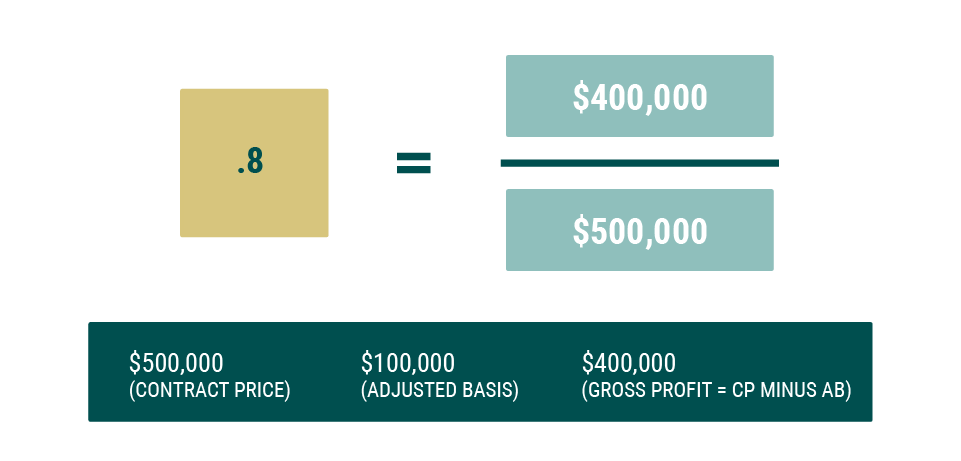

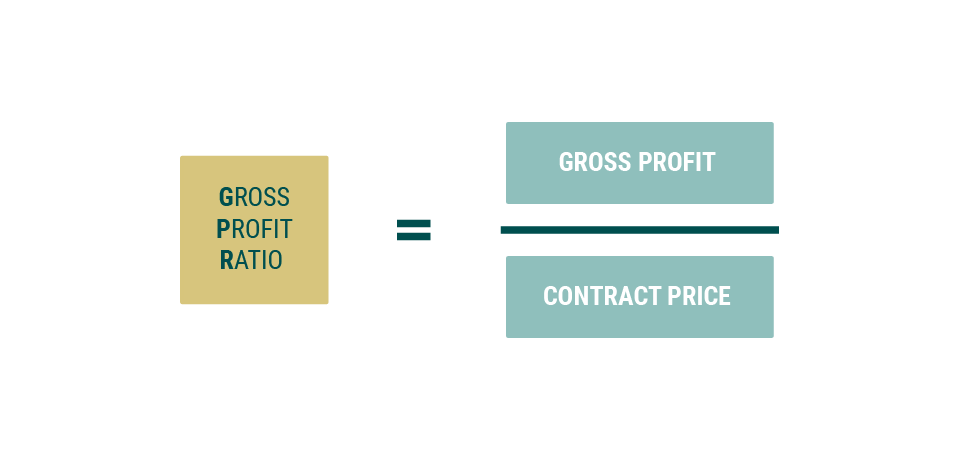

A Deferred Sales Trust TM is a viable financial strategy often used to defer capital gains taxes. A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed in. Go to slide 2.

You should be able to focus on selling your real estate business what makes your wealth grow and what gives you the most freedom to enjoy. Deferred Sales Trusts unlike exchange-based tax. The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property.

Hence the final year-end sales tax collection figure cant be determined until the December Part County Collection. Instead of collecting the money the trust is used as a bridge to fund the next investment. Capital gains refer to the profit you made off your.

And heres the thing. Go to slide 1.

Overcoming False Beliefs Of The Deferred Sales Trust Youtube

Combining Life Insurance With The Deferred Sales Trust With Chris Naugle Capital Gains Tax Solutions

Deferred Sales Trust Irs Irs Capital Gains Tax

Advanced Planning Deferred Sales Trusts The Quantum Group

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Tax Deferral And Savings With A Deferred Sales Trust

Deferred Sales Trust Defer Capital Gains Tax

Worthpointe Financial Planners What Is A Deferred Sales Trust And Why You May Consider One Worthpointe Financial Planners

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust Introduction Jrw Investments

Defer Capital Gains Taxes On The Sale Of Your Investment Property Using A 1031 Exchange

Deferred Sales Trusts How Do They Work Cohan Pllc

Why You Should Consider Using The Deferred Sales Trust More Than Ever